The cloud keeps the modern world running — quietly powering the apps we use, the data businesses depend on, and the systems behind hospitals, schools, and governments. Instead of relying on physical servers, organizations now turn to cloud infrastructure to store data, run software, and work securely from anywhere.

As more teams embrace the cloud for speed, scale, and smarter operations, it’s worth asking: who’s leading the way — and where is the market heading? Because in a space evolving this fast, understanding isn’t just insight — it’s opportunity. Knowing where the momentum is can help us choose the right platforms, make better investments, and align with the technologies shaping the future.

This report offers a clear, data-backed snapshot of today’s cloud infrastructure landscape — highlighting revenue leaders, market shifts, and platform growth. We take a closer look at Microsoft Azure and the growing preference for tools that are not only powerful, but deeply integrated and AI-ready — giving modern businesses a smarter path forward.

Who’s Leading Cloud Infrastructure Today?

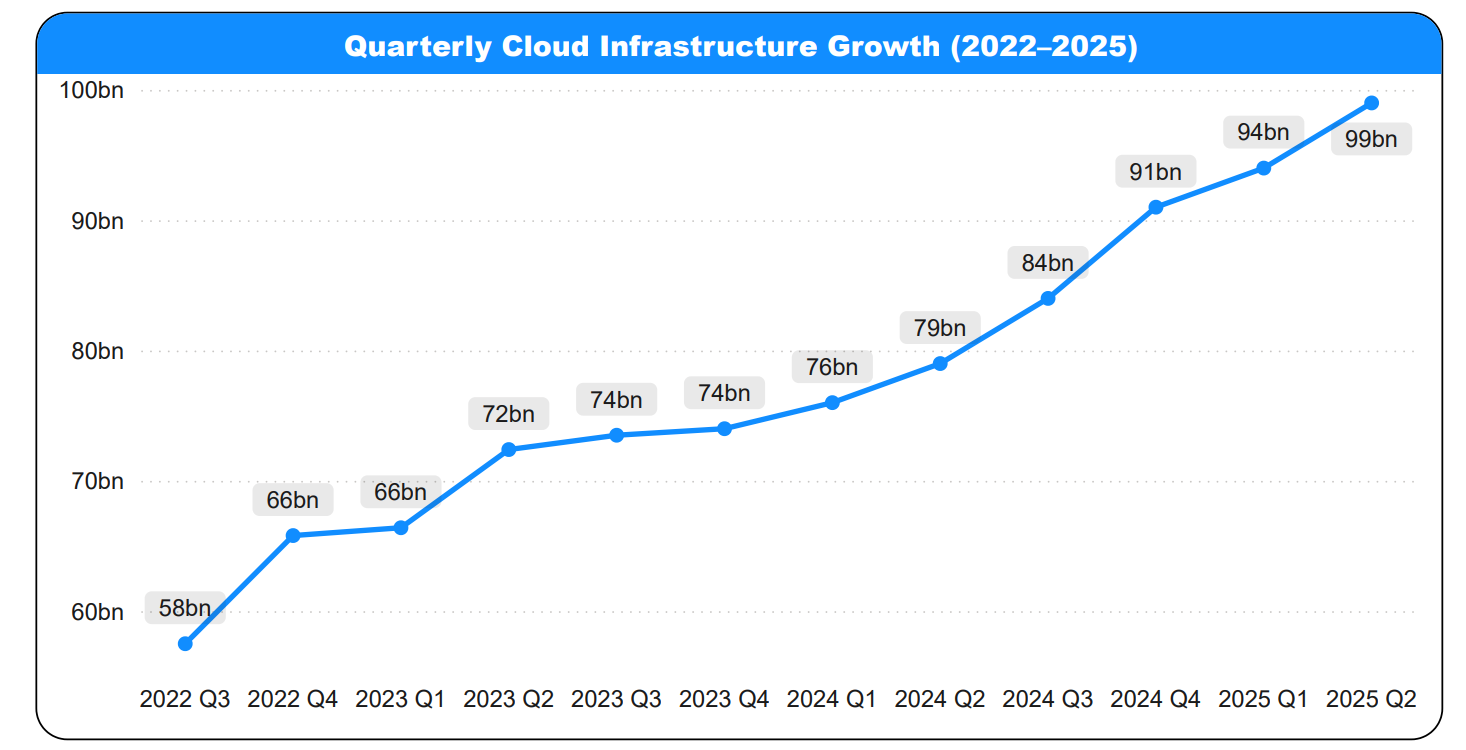

To understand just how fast cloud infrastructure is growing, we’ll begin by examining the market’s revenue trends over the past few years. This data offers a clear view of how rapidly businesses around the world are adopting cloud technologies — and how essential these services have become to modern operations.

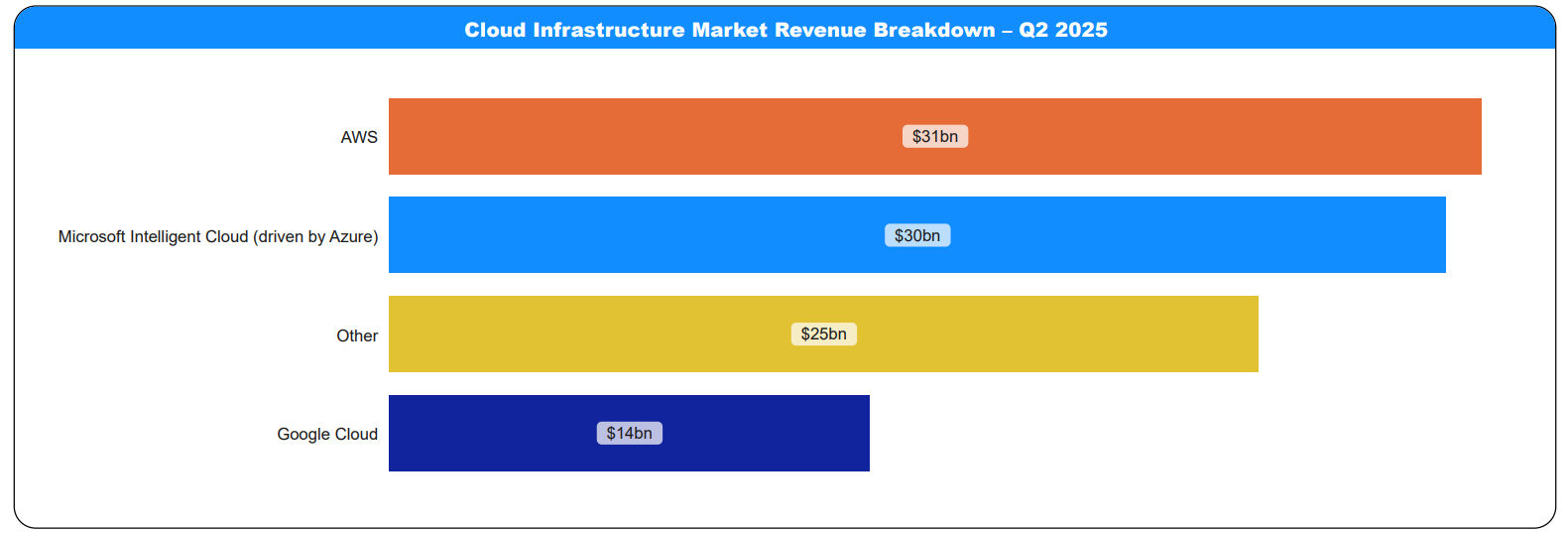

From there, we’ll take a closer look at the most recent quarter to see which providers are leading the market — and how their positions reflect broader shifts in cloud strategy.

The line chart above illustrates how global enterprise spending on cloud infrastructure has steadily grown — from $58 billion in Q3 2022 to $99 billion in Q2 2025. This sharp climb reflects more than just market growth; it signals how deeply organizations are embedding cloud into their core operations. From secure data storage to AI-powered tools, businesses rely on the cloud not only for efficiency but also for flexibility, scalability, and innovation. With spending continuing to rise, it’s clear that cloud infrastructure has become essential to modern business.

While the global cloud infrastructure market has reached $99 billion, the chart above reveals how that revenue is distributed—and who’s capturing the largest shares. The market is clearly dominated by three major players: AWS leads with $31 billion in revenue, closely followed by Microsoft Intelligent Cloud, powered by Azure, at $30 billion, with Google Cloud coming in third at $14 billion. The remaining $25 billion is divided among other providers like Alibaba, Oracle, Salesforce, and IBM. This concentration highlights how a handful of key leaders are not just capturing the majority of market revenue, but are also setting the pace and direction for the future of cloud infrastructure.

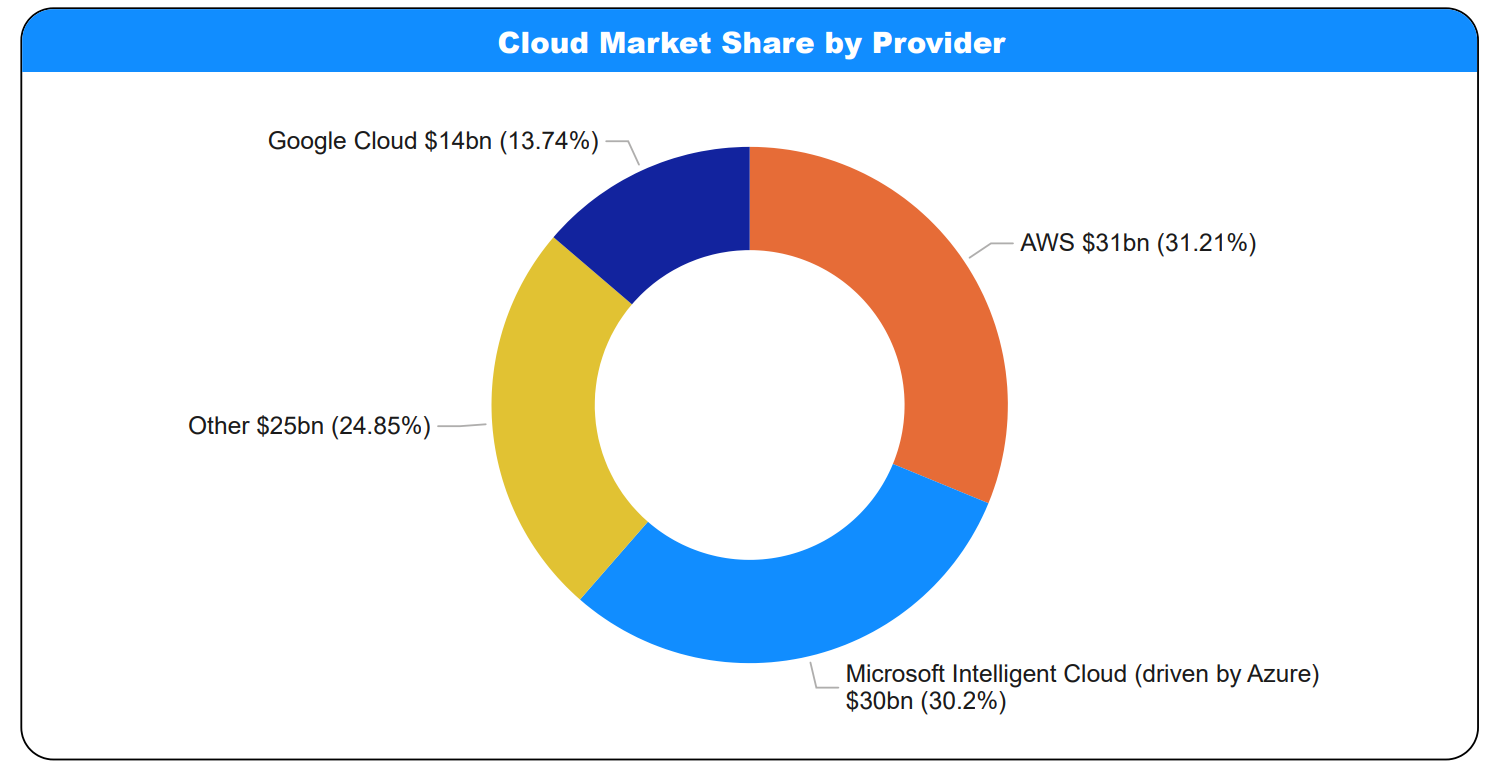

Above, the donut chart shows the exact market share captured by each provider. Together, AWS, Microsoft, and Google control over 60% of the global cloud infrastructure market, while the rest share mostly single-digit percentages. This highlights the clear dominance of these three leaders—where enterprises are placing their trust—and illustrates how concentrated yet fiercely competitive the market has become, with these players driving the next wave of cloud innovation.

What Market Caps Signal for the Future of Cloud

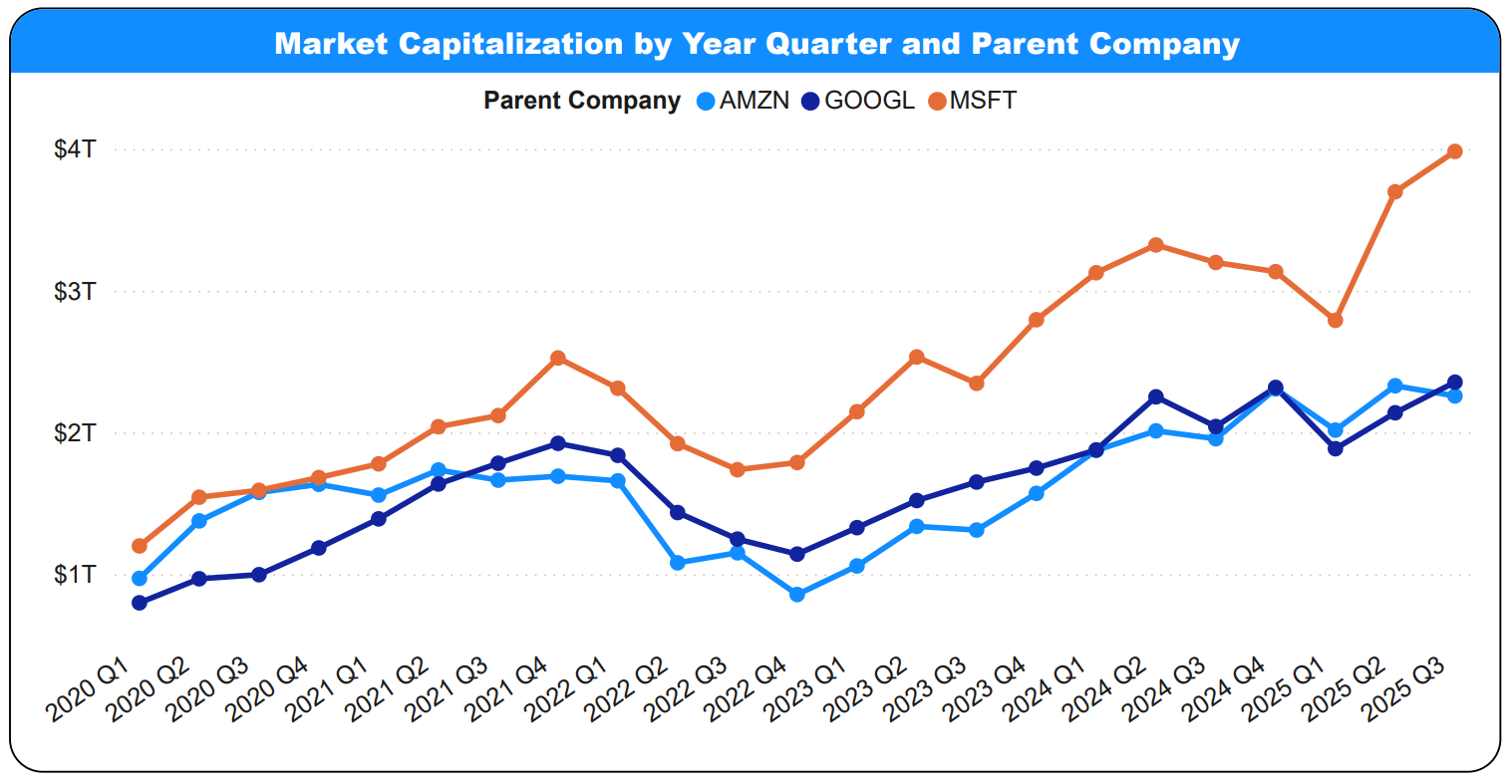

While revenue and market share reveal who’s winning in the cloud today, market capitalization offers a window into who’s best positioned for the future. Let’s take a closer look at the parent companies behind these cloud giants — Microsoft, Amazon, and Google — and how they’re moving at different speeds in terms of overall growth, investor confidence, and long-term momentum.

The line chart above shows Microsoft leading in market capitalization over the past five years, with a sharp 2023 surge that put it well ahead of Amazon and Google. This reflects strong investor confidence in Microsoft’s strategy and expanding cloud influence. Amazon began strong in second place but was overtaken by Google in 2021. Both dipped in 2022 but have since recovered, with Google holding a slight lead. This close competition highlights the ongoing race for market dominance.

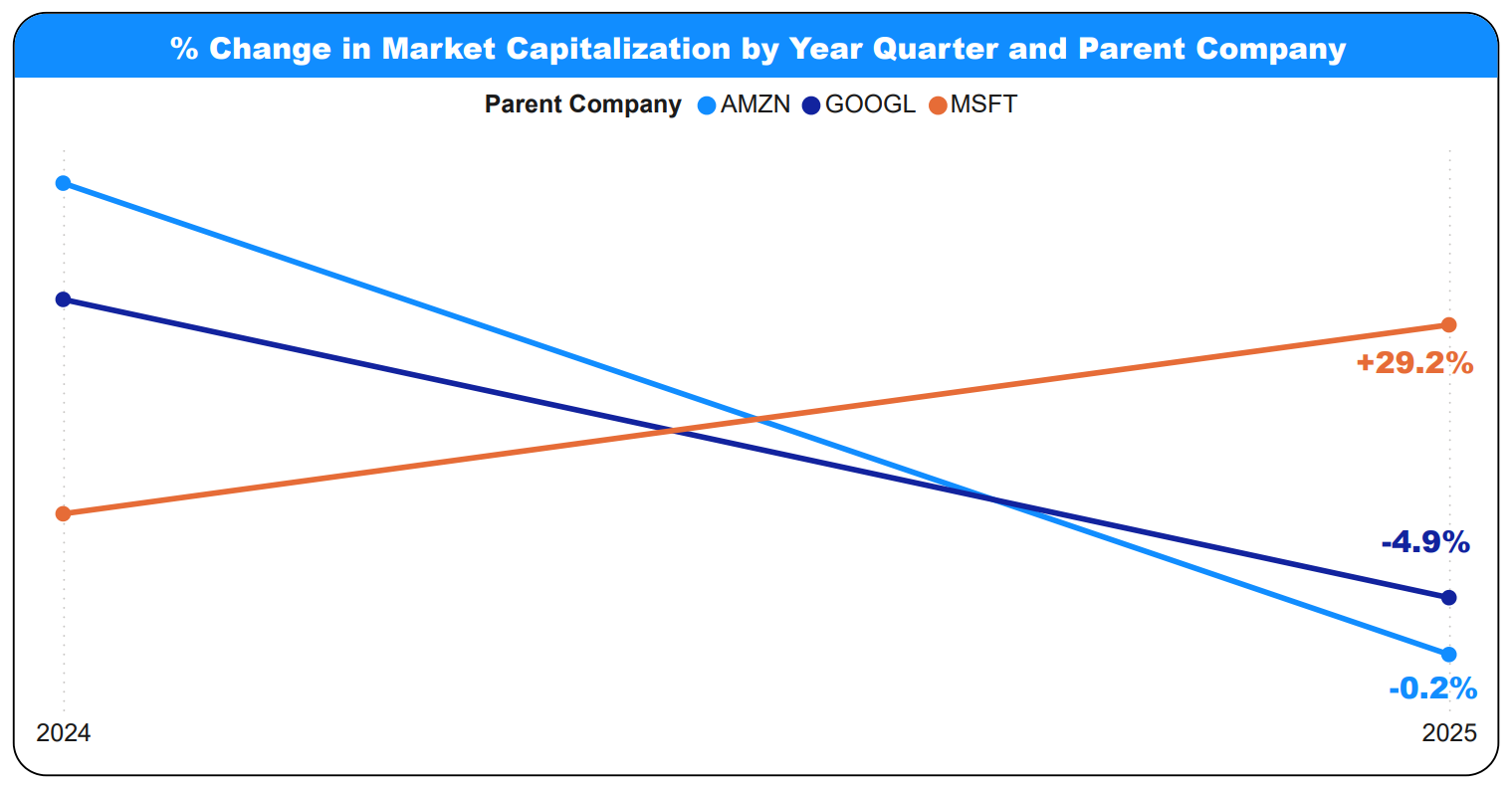

Zooming in on market cap growth from 2024 to 2025, Microsoft’s value surged by over 29%, widening its lead even further. In contrast, Amazon’s market cap dropped 4.9%, and Google’s dipped slightly by 0.2%. This contrast highlights Microsoft’s accelerating momentum, while Amazon and Google face challenges in maintaining growth.

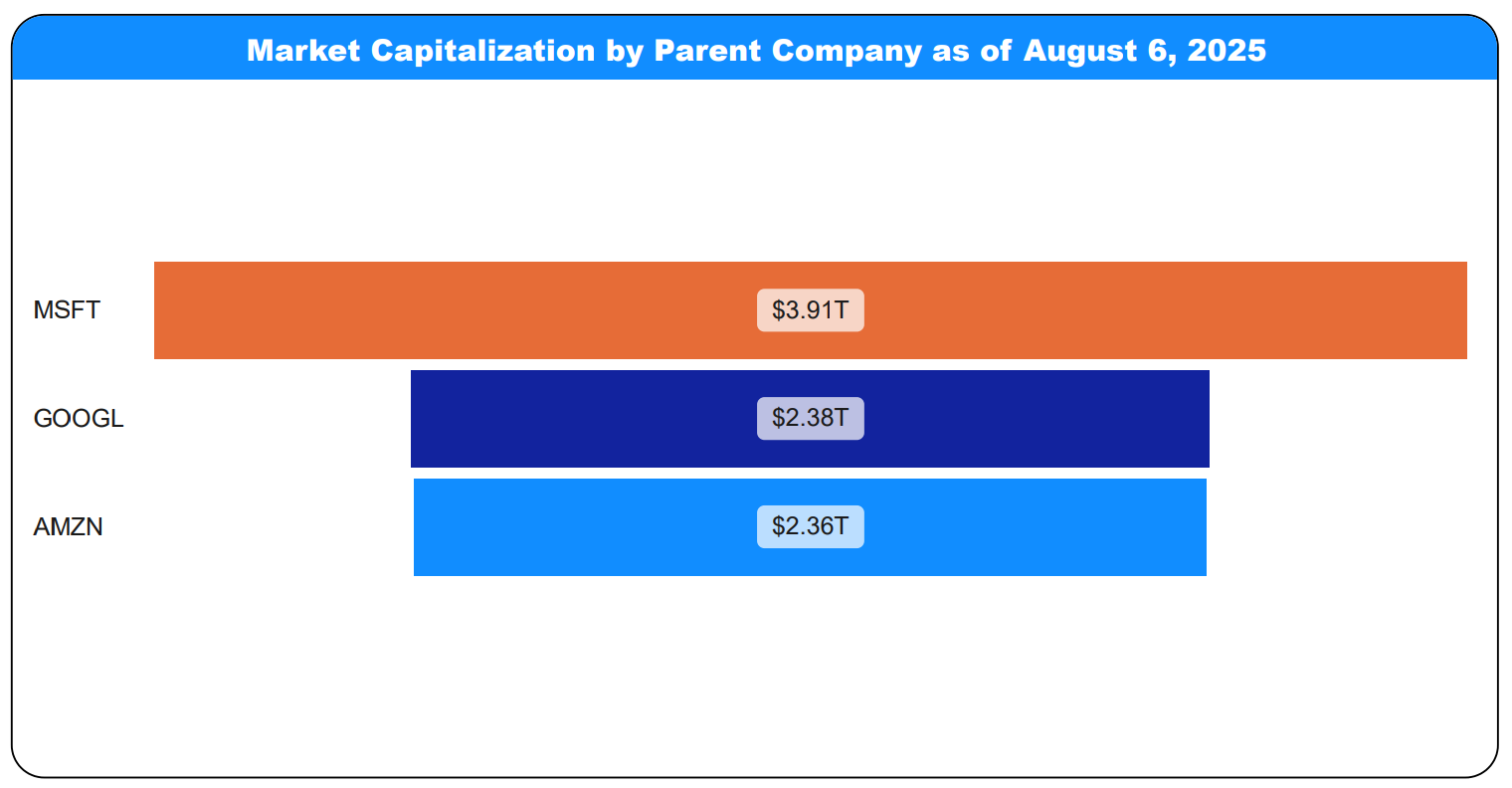

The funnel chart above brings these numbers into focus: as of August 2025, Microsoft’s market capitalization stands at $3.91 trillion, significantly ahead of Google’s $2.38 trillion and Amazon’s $2.36 trillion.

So, while AWS leads in cloud revenue, Microsoft’s higher market cap and stronger growth suggest that investors see greater long-term potential in Microsoft intelligent cloud and its broader strategy—positioning Microsoft to lead the next wave of cloud innovation.

What’s Driving Azure’s Momentum?

At Extrada Tech, we pride ourselves on staying ahead of the curve—digging into the data, listening to our clients, and focusing on solutions that genuinely make work easier. That’s why we keep a close eye on what’s shaping the future of the cloud.

Right now, the momentum is clear. While AWS still leads in revenue and market share, Microsoft’s Intelligent Cloud—driven largely by Azure—is rapidly gaining ground. Its rising market capitalization and sustained growth reflect strong investor confidence in where Azure is headed. And we’re seeing that confidence play out every day.

More and more of our clients are choosing Azure as their cloud foundation — whether they’re looking to improve reporting, automate tasks, scale with ease, or unlock more value from their data. And it’s easy to see why. The tools feel practical, powerful, and naturally integrated into the way teams already work.

With deep integration across Microsoft 365, Teams, and Power Platform, along with AI-first tools like Copilot and Microsoft Fabric, plus flexible hybrid infrastructure and a unified data ecosystem perfect for complex industries—Azure is hitting the mark.

Investors believe in it. Clients are excited about it. And based on what we’re seeing and building today, we believe Azure is well positioned to lead the future of cloud.

So, if you’re looking to modernize, there’s real advantage in leaning into Azure’s momentum. And if you’re curious or want to chat about what this might mean for your team, we’re always here to listen and share ideas.

References

Total Cloud Infrastructure Market Revenue